Profitability has been the most important bottleneck that has been hampering large scale electric car manufacturing since forever. Tesla Motors (TSLA) found the perfect moment and strategy to start producing electric cars and is now offering Supercharging that is profitable for both the company and the end user.

Profitability has been the most important bottleneck that has been hampering large scale electric car manufacturing since forever. Tesla Motors (TSLA) found the perfect moment and strategy to start producing electric cars and is now offering Supercharging that is profitable for both the company and the end user.

An analysis started from several assumptions of possible figures and scenarios, made by Siddharth Dalal, a contributor on SeekingAlpha, unveils that Elon Musk thought well when he decided to increase the sales of his cars by offering lifetime free charging.

The assumptions were as follows:

- 25 charges per year per car

- $10 per charge cost to Tesla

- $225k cost for each Supercharging station

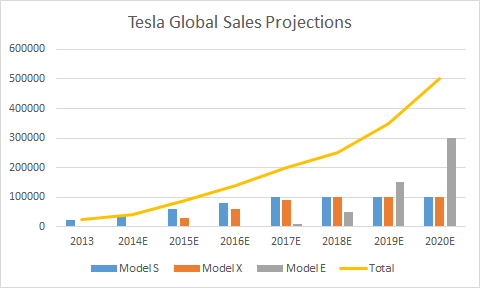

Considering the Supercharger adoption rate of 100% in 2012 and 75% from 2019 onwards, Siddharth drew a graph of Supercharger revenues vs costs:

…and the Supercharger profit per car:

Now, these are rough estimates, made with publicly available data and some assumptions. I’m sure Elon and his team did a fine job with their own estimates and if the Superchargers are still in place and they’re building new ones faster than ever before, something’s true about Siddhart’s prediction. A profit of more than $500 per car is way above the break-even point and the trend even matches logically with the fact that the more cars Tesla produces, that curve closes in to a certain figure.

Some commenters to the Seekingalpha article who already own a Tesla Model S were eager to report that they don’t actually use Supercharging much in their daily usage of the car, but rather on journeys that need more energy than their battery can store. So the profit margin may be even higher, considering you pay $2,000 for having the Supercharging enabled in the low-end $60k Model S (maybe that’s what it costs Tesla to charge your car, predicted for its entire lifetime).

In the end, Siddhart pulls the conclusion that Tesla “can make more money on Supercharging than GM can make overall” (off the Volt). That’s a fine conclusion, considering that Tesla is only a few years old and GM is 106.

[all the graphs in this article belong to Siddharth Dalal/seekingalpha]

Install solar panels and used model S battery packs at the superchargers and net meter the surplus to the utilities…Tesla makes the batteries and solar panels.